Saudi Arabian Airlines (Saudia), the Kingdom's national carrier, plans to raise as much as SR5 billion ($1.33 billion) in Islamic bonds in the second quarter to refinance existing debt and purchase new aircraft, an airline official said.

Saudia is in negotiations with local banks, the airline's Director General Saleh al-Jasser was quoted as saying in a Bloomberg interview on the sidelines of last week’s Bahrain airshow.

A Saudia spokesman confirmed the details to Reuters.

The carrier is planning to expand its fleet to 200 aircraft by 2020 from a current fleet of 157, according to a fleet tracking website. It will receive 29 new aircraft in 2016 as it plans to increase frequency on some existing routes as well as launch new routes to the Maldives, Munich, Algiers and Ankara, the spokesman said.

It will also retire about 19 aircraft in the coming years.

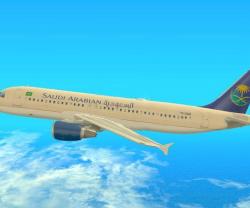

Saudia placed an order for 30 A320neo planes and 20 A330-300 Regional aircraft (photo) worth around $8.2 billion at the Paris airshow last year, to be used for domestic and regional routes.

The delivery and financing of these aircraft will be done by Islamic financing in a sale and leaseback deal with Dubai-based International Airfinance Corporation (IAFC).

Saudia is the third largest in the Middle East in terms of revenue, behind Emirates and Qatar Airways. It operates domestic and international scheduled flights to over 120 destinations in the Middle East, Africa, Asia, Europe and North America. Domestic and international charter flights are operated, mostly during the Ramadan and the Hajj season.

Saudia is a member of the Arab Air Carriers Organization. The airline joined the SkyTeam airline alliance on 29 May 2012.