Dubai Aerospace Enterprise (DAE) Sells MRO Unit

10.07.2015 Aviation Space

Leasing firm Dubai Aerospace Enterprise (DAE) has announced the sale of its unit StandardAero, an engine maintenance, repair and overhaul (MRO) company, to an affiliate of private equity firm Veritas Capital.

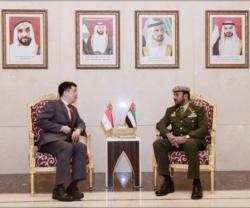

This comes following an agreement reached between the two parties in May, said Khalifa H Al Daboos, Managing Director of DAE (photo).

A globally recognized aerospace company headquartered in Dubai, DAE did not disclose the value for the deal.

However, the company had earlier said that it will use the proceeds from the sale to expand the rest of its operations, including to "aggressively acquire" more aircraft to expand it leasing business.

With a current net book value of $3.7 billion, DAE said it will refocus its efforts in building an aerospace footprint from Dubai.

Scottsdale, Arizona-based StandardAero provides engine MRO and nose-to-tail services that include airframe and interior refurbishment, and paint for commercial and military aircraft.

DAE had acquired the US-based firm in 2007, soon after it was set up with the ambition to become one of the world's largest aircraft lessor but was forced to cancel plane orders during the global credit crunch and Dubai's debt crisis.

This comes following an agreement reached between the two parties in May, said Khalifa H Al Daboos, Managing Director of DAE (photo).

A globally recognized aerospace company headquartered in Dubai, DAE did not disclose the value for the deal.

However, the company had earlier said that it will use the proceeds from the sale to expand the rest of its operations, including to "aggressively acquire" more aircraft to expand it leasing business.

With a current net book value of $3.7 billion, DAE said it will refocus its efforts in building an aerospace footprint from Dubai.

Scottsdale, Arizona-based StandardAero provides engine MRO and nose-to-tail services that include airframe and interior refurbishment, and paint for commercial and military aircraft.

DAE had acquired the US-based firm in 2007, soon after it was set up with the ambition to become one of the world's largest aircraft lessor but was forced to cancel plane orders during the global credit crunch and Dubai's debt crisis.

Previous PostSaudi Arabia Launches $1.2 Billion Madinah Airport

Latest news

Latest events

DefenPol China2025 - 7th Guangzhou International Defense & Police Exhibition & Summit

11 - 12 Jul 2025Nan Fung International Convention & Exhibition Center (NICEC) - ChinaIDEF 2025 Turkey - International Defence Industry Fair

22 - 27 Jul 2025Istanbul Expo Center - TurkeyDSEI 2025

09 - 12 Sep 2025Excel, London - United KingdomIntersec Saudi Arabia

29 Sep - 01 Oct 2025Riyadh International Exhibition & Convention Centre - Saudi Arabia